What is the Difference Between Buying and Selling a Butterfly?

Simple, risk verses reward.

I bet you wanted more than that right?

Well, if you insist. Let’s take a couple of real life examples looking at the market right now.

Let’s look at TSLA which is trading at $297.04 right now with an implied volatility of 55.97 which is important but this is not a Butterfly Strategy article, just about the differences in buying and selling a butterfly.

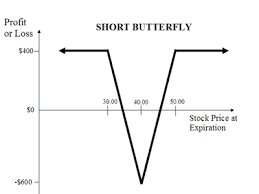

So let’s start by selling the MAR15 280/295/310 Butterfly for $1.33.

We are going to use Call Butterfly’s in our example. You could use Puts as well depending on which gives you the best return.

To open this trade we would

Sell 1 MAR15 $280.00 Call

Buy 2 MAR15 $295.00 Calls

Sell 1 MAR15 $310.00 Call

We bring in a total of $1.33 or $133.00 for selling this butterfly. Our probability of success if we held this butterfly until expiration is about 87% that we will get to keep our entire $133.00

Our Break even points are $281.34 and $308.65 at expiration. We are risking, and would lose if it finished exactly at about $294.60, $1,367.00

So if we sell this TSLA butterfly we are risking $1,367.00 to make $133.00 with an 87% chance we will be at break even or better.

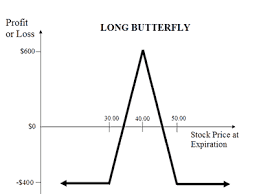

So, what if we bought this butterfly instead of selling it?

To open a buy we would:

Buy 1 MAR15 $280.00 Call

Sell 2 MAR15 $295.00 Calls

Buy 1 MAR15 $310.00 Calls

We would pay (instead of receive) $1.33 or $133.00 out of our pocket. Our maximum return if TSLA finished right at $294.60 would be $1,367.00 and our break evens would be at $281.34 and $308.65 just like before.

Our maximum risk on this trade is $133.00 and our maximum profit would be $1,367.00. Sounds great right? However, we only have a 13% chance of breaking even or better. Probably about a 1% chance of making the maximum profit of $1,367.00.

So, which is better on this trade? Selling a butterfly with higher risk and lower returns but a 87% chance of success

-or buying a buttefly with a low risk and huge return with a 13% of break even or better and about a 1% chance or less of maximum return?

In this example, we would SELL the butterfly EVERY TIME! Buying this butterfly is just gambling.

There are times when it might make sense to buy a butterfly but certainly not here; at least not to us anyway.

Let us know what you think, comment below!

Originally Published by Jim Dawson at Trade4Profits.com