What is the Difference Between Buying and Selling an Iron Condor?

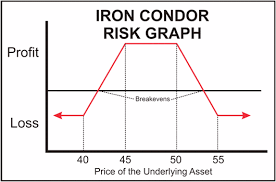

Risk, reward and probability of success.

Like most things in life the more risk you take the higher your potential reward but the lower chance of success. This is buying an Iron Condor

On the other hand, if you take less risk your reward potential is lower but you have a higher chance of success.

Now, there are LOTS of ways to construct an Iron Condor so you can potentially skew these rules one way or another. We are going to look at buying and selling Iron Condors in the terms of the way we trade.

What makes the difference, other than buying or selling, is the width of your Iron Condor, the difference between your strikes and how far out of the money you start.

We are going to look at the March 2019 expiration options today. They have about 46 days left until expiration.

We are not going to discuss which stocks to sell or buy, which makes a difference based on volatility which affects option prices. That is another discussion.

Today we are going to look at FB which is trading at $149.01.

We are going to look at the MAR19 125/130 Puts and the 170/175 Calls.

We are going to start by selling an Iron Condor

Buy the $125.00 PUT

Sell the $130.00 PUT

Sell the $170.00 CALL

Buy the $175.00 CALL

We can sell this for $1.15 or $115.00 per contract. Our risk is $385.00 and our probability of finishing at Break Even or better is 67%

To be profitable we need FB to close on expiration somewhere between $128.86 and $171.15

If we wanted to buy this position it would look like this:

Sell the $125.00 PUT

Buy the $130.00 PUT

Buy the $170.00 CALL

Sell the $175.00 CALL

This time we would have to pay the $1.15 or $115.00 per contact. The most we can lose is we buy an Iron condor is the debit or $115.00 in this case. We can potentially make $385.00 provided FB finishes below $128.86 or above $171.15.

However, our chance of this happening is only 33%.

So, do you want a 67% chance to make $115.00 or a 67% chance to lose $115.00?

There is another little secret when we sell and Iron Condor that increases our chance of success. We rarely

hold until expiration. We increase our probability of success by taking 40% or 50% or 60% of our potential profit using a Good to Close (GTC) order. This substantially increases our chance of success when selling an Iron Condor and something you can’t really do when you buy an Iron Condor.

Originally Published by Jim Dawson on Trade4Profits.com